Your complete guide to pet insurance in Canada

There's been a rise in pet ownership across Canada in the last decade. This was especially evident during COVID-19, when everyone had to stay home for a period of time. If you're living alone, pets are great for companionship. For families, having an animal around was a good way to keep children engaged and stimulated during so much stay-at-home time.

If you're thinking about getting a pet, read our guide to pet adoption in Canada, where you can find out everything you need to know.

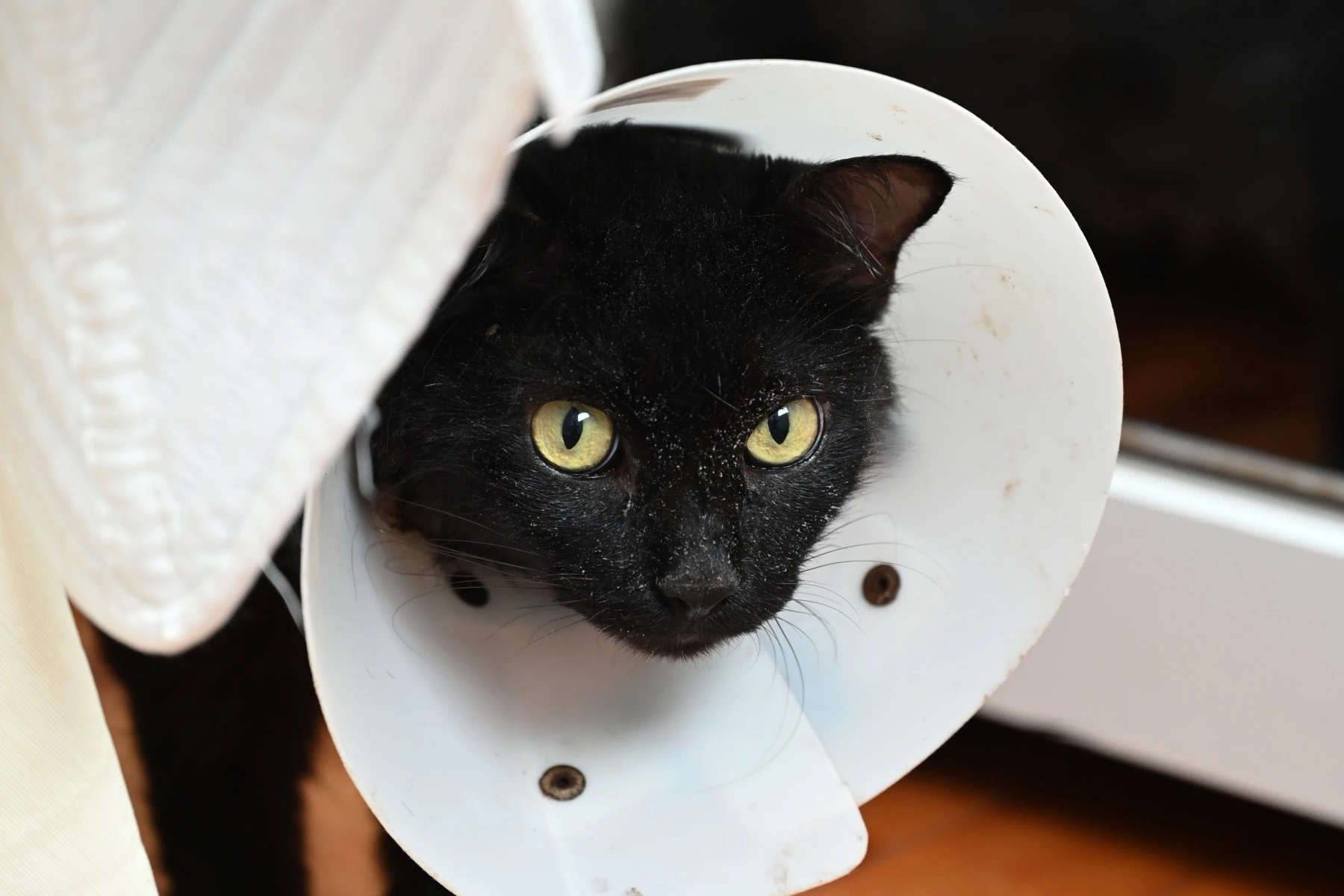

Pet ownership is endlessly rewarding, and also comes at a cost. Vet bills are not cheap, and an emergency trip to the vet can put a massive dent in your savings in the blink of an eye. Many animal lovers are opting for pet insurance to avoid the financial shock of a vet bill.

This guide will help you understand how pet ownership works, decide whether it’s worth it, and choose the best plan for your pet.

What is pet insurance?

Pet insurance is medical coverage for your pet in the case of an accident or illness.

Some plans have the option of adding “wellness” coverage, for preventative care that keeps your animal healthy. You can also add on cover for vaccinations, heartworm prevention and dental maintenance in a wellness package.

Similar to other types of insurance, pet owners pay a regular monthly premium. There are different tiers of cover, depending on how much of a deductible you want to pay in the case of filing a claim. Claims are reimbursement-based. Pet insurance covers expenses such as:

- Accident care

- Illness treatment

- Surgeries

- Prescriptions

Treatment for pre-existing conditions, dental care and routine checkups are generally not covered. They can, however, be added to your plan.

What are the main differences between pet insurance and human health insurance?

Pets are legally considered property, so pet insurance functions more like property insurance. Instead of the care provider billing the insurance company directly, claims are reimbursement-based.

By law, human health insurance is required to cover pre-existing conditions, while with pet insurance, this isn’t the case.

Human health insurance is generally quite expensive, from CA$250 and upward per month. Pet insurance ranges from around CA$25 per month for cats and $50 per month for dogs.

Both types of insurance have the same end goal—to minimise financial burden related to healthcare costs.

Types of pet insurance available in Canada

It’s up to you, the pet owner, to decide what type of coverage you want for your pet, and there are a few types of insurance to choose from:

- Accident-Only Plans: These are more affordable plans, but have limited coverage.

- Accident & Illness Plans: This is the most common and comprehensive type of pet insurance available.

- Wellness Plans (Optional Add-Ons): This covers your pet for routine care, vaccinations, flea prevention, and other common issues.

- Customisable Plans: These plans allow the pet owner to tailor their coverage based on specific needs and budget. You can choose your deductible amount, reimbursement rate, and annual coverage limit.

Optional add-ons to pet insurance

Many Canadian insurers offer optional add-ons. Perhaps your pet has bad teeth, so it may be worth it to have dental care covered. As your pet gets older, you may want to consider preventative care coverage.

Some pets respond well to alternative therapies such as chiropractor visits, and coverage for this can often be added to your plan. Breeds are a factor in health maintenance too. For example, some dog breeds are known for having bad hips as they age.

The flexibility of customisable pet insurance plans makes it easier to find a plan that fits your pet’s breed, age, and health history.

How much does pet insurance cost in Canada?

On average, monthly pet insurance premiums range from $30-$90 for dogs and $20-$50 for cats. Coverage for dogs costs a little more because they tend to have more health issues and larger vet bills.

Your pet's breed, age, and your location will also influence the rate of your premium. For example, the cost of living in Canadian urban centers such as Toronto and Vancouver is higher. This includes vet costs. This is reflected in local insurance rates.

Other factors influencing insurance rates include:

- The deductible you choose (how much you pay out of pocket before insurance kicks in).

- Your reimbursement rate (how much the insurer pays back after a claim)

- Your annual or lifetime coverage limits.

Just like with other types of insurance, the more coverage you want, the more you’ll pay each month. The optional add-ons mentioned in the previous section will also cause your monthly rate to go up.

It’s up to you how much coverage to get. The best thing you can do is research your animal’s breed and consider their age and health history before customising your plan.

Choosing the right plan for your pet

- Firstly, evaluate your pet’s age, breed and current state of health.

- Set a budget by determining how much you can afford both monthly and in the case of an emergency.

- Next, research various providers.

Major pet insurers in Canada

Trupanion

If you’re looking for simplicity and fast payouts, Trupanion is a favourite among Canadian pet owners. It covers 90% of eligible vet bills with no payout limits—ever. Unlike most insurers, Trupanion can pay your vet directly at checkout. This means no waiting for reimbursement. Your pet's coverage also starts from as young as 8 weeks. If needed, you can add recovery and complementary care, like physiotherapy or acupuncture.

Best for: Hassle-free claims and lifetime illness/injury coverage.

View this post on Instagram

Petsecure

Proudly Canadian and in the game for over 30 years, Petsecure offers four flexible plan levels that cover everything from accidents to wellness care. You can even get dental, behavioural therapy, and alternative treatments included depending on your plan. They also donate part of their profits to animal shelters across Canada, which makes your policy feel even more meaningful.

Best for: All-around coverage for your pet.

View this post on Instagram

Fetch (formerly Petplan)

Fetch takes a more customized approach. You get to set your deductible, reimbursement rate, and annual limit, which is ideal for pet owners who want more control. It covers chronic conditions, dental illness, and even virtual vet visits. Their app makes claims easy, and coverage applies both in Canada and the US, which is handy for cross-border travellers.

Best for: Customizable coverage, depending on your pet's needs.

View this post on Instagram

Desjardins

As part of one of Canada’s leading financial groups, Desjardins Pet Insurance offers simple accident and illness plans, plus optional wellness coverage. You can bundle your pet insurance with other Desjardins policies, like home or auto, which may help you save. Claims are processed quickly, and coverage includes exam fees and diagnostics.

Best for: Pet parents already insured with Desjardins.

View this post on Instagram

PC Insurance

Offered through President’s Choice Financial, PC Pet Insurance gives you no-fuss coverage with three tiered plans and optional add-ons like dental or wellness care. You can earn PC Optimum Points with your premiums, which is a nice bonus if you already shop at Loblaws-affiliated stores. It’s one of the more affordable options for basic accident and illness coverage.

Best for: Budget-conscious shoppers who love a loyalty program.

View this post on Instagram

How to make sure you've got the right coverage for your pet

- Scour websites to find out coverage limits, deductibles and reimbursement options. The fine print will reveal exclusions and wait times for each company and plan.

- Customer reviews always provide honest feedback about claim experiences.

- You can always ask your vet for advice and recommendations.

Just like with any major purchase, research is imperative so that you can have peace of mind when you finally make your choice. Your beloved pet is worth it.

Want more moving and lifestyle tips as a pet owner in Canada? Check out our guide on flying with pets.

FAQs about pet insurance in Canada

Is pet insurance worth it in Canada?

Yes—for many pet owners, it’s worth the peace of mind. Unexpected vet visits can cost hundreds or even thousands of dollars. Pet insurance helps reduce financial stress by reimbursing you for covered treatments. It’s especially valuable for breeds prone to health issues or pets prone to accidents.

How much does pet insurance cost in Canada?

Costs vary depending on the provider, your pet’s breed, age, and your location. On average, expect to pay:

- Dogs: CA$40–CA$90 per month

- Cats: CA$20–CA$50 per month

Plans with higher coverage or add-ons (like dental or wellness) will cost more.

What does pet insurance cover in Canada?

Most plans cover:

- Accidents and injuries

- Illnesses

- Surgeries

- Prescription medications

- Hospitalisation

Optional add-ons can cover:

- Routine checkups

- Vaccinations

- Dental care

- Alternative therapies (e.g. acupuncture, chiropractic)

What’s not covered by pet insurance?

Typical exclusions include:

- Pre-existing conditions

- Routine wellness care (unless added)

- Cosmetic procedures

- Breeding or pregnancy-related costs

Always read the fine print for exclusions and waiting periods.

Can I get pet insurance for an older dog or cat?

Yes, many providers offer insurance for senior pets, though premiums will be higher and coverage may be limited. It’s best to insure your pet while they’re young and healthy to avoid exclusions for pre-existing conditions.

Who are the best pet insurance providers in Canada?

Top-rated companies include:

- Trupanion

- Petsecure

- Fetch by The Dodo (formerly Petplan)

- Desjardins Pet Insurance

- PC Pet Insurance

Each has different coverage levels, deductible options, and claims processes—so compare carefully.

How do pet insurance claims work?

In most cases, you pay your vet bill upfront, then submit a claim for reimbursement. You’ll need to provide your invoice and sometimes your pet’s medical history. Some providers like Trupanion offer direct vet payments at participating clinics.

Can I use pet insurance at any vet in Canada?

Yes, almost all pet insurance providers in Canada allow you to visit any licensed veterinarian, including emergency and specialist clinics.

When should I get pet insurance?

The sooner, the better. Getting coverage while your pet is young helps you avoid exclusions for pre-existing conditions and often lowers your monthly premium.